Analysis of Monday's Trades:

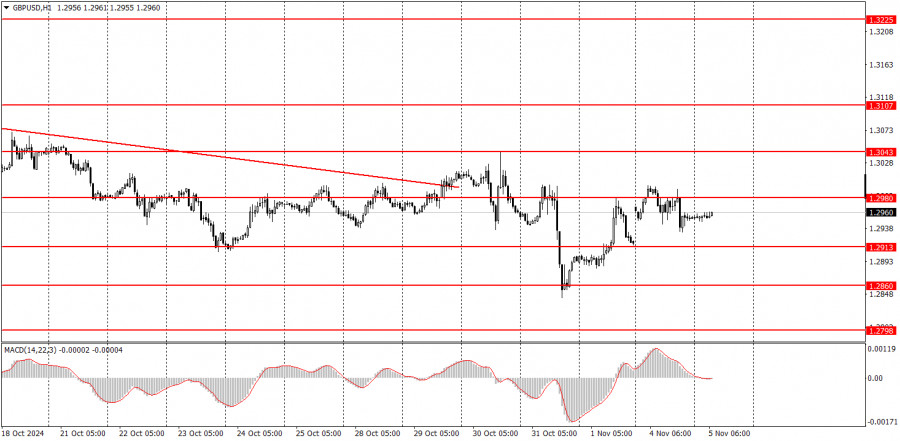

1H Chart of GBP/USD Pair

On Monday, the GBP/USD pair also slightly increased, but it didn't last long. The British pound rose following the release of weak U.S. macroeconomic data, which might prompt the Federal Reserve to shift to a more dovish stance. However, it's difficult to say that a correction has begun. Last week, the euro received some news support from the European Union. Although it wasn't particularly strong, it was still there. In the U.K., there were no significant events, so the pound declined willingly, with or without reason. We continue to support the further decline of the British currency, even without macroeconomic and fundamental reasons. As a result, the pound has yet to reach the last local high. So, is this a correction? It's more like a standard pullback. The pound may rise this week, but only if the Fed takes a dovish stance on Thursday and expresses concerns about labor market weakness.

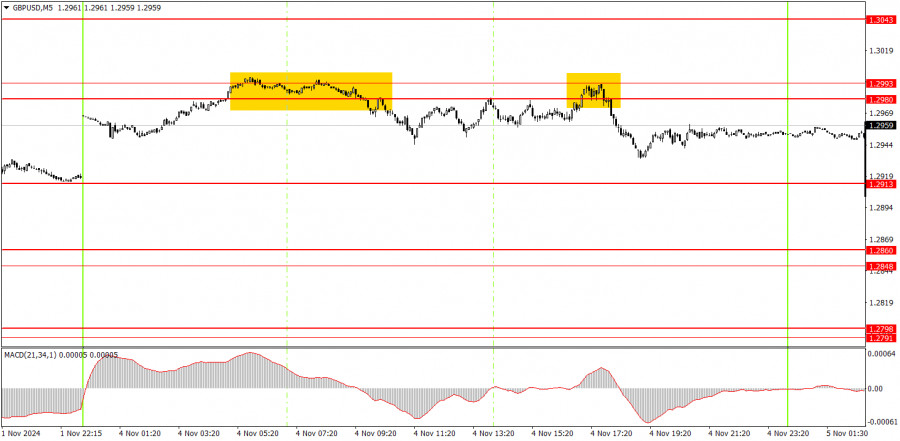

5M Chart of GBP/USD Pair

In the 5-minute timeframe on Monday, the price bounced twice from the 1.2980-1.2993 area. The first time, the price moved down by about 25 pips, and the second time, by around 30. As a result, neither short position would have led to a loss, only to a small profit.

How to Trade on Tuesday:

In the hourly time frame, the GBP/USD pair has attempted to start a correction after a month-long decline, but it has failed. In the medium term, we fully support the pound's decline, which is the only logical direction. The British pound might try to correct again in the near future, but it would need macroeconomic and statistical support for that. Last week showed that such support is scarce, and even when it's present, the pound struggles to rise.

On Tuesday, novice traders may consider trading within the 1.2980-1.2993 area. Yesterday, the price bounced from this area twice, so selling from this level remains relevant.

On the 5-minute time frame, trading is possible at the following levels: 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, 1.3365. No significant events are scheduled in the U.K. on Tuesday, but the U.S. will release the ISM Services PMI, which will be the key event of the day.

Basic Trading System Rules:

- The strength of a signal is determined by the time it takes to form (whether a bounce or breakthrough of a level). The quicker the formation, the stronger the signal.

- If two or more trades have been made near a level due to false signals, any further signals from that level should be ignored.

- In a flat market, a pair can generate many false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trading occurs between the start of the European and middle of the US sessions, after which all trades should be manually closed.

- On the hourly time frame, it's recommended to trade MACD indicator signals only when there is good volatility and a trendline or trend channel confirms a trend.

- If two levels are too close together (5 to 20 pips apart), they should be treated as support or resistance areas.

- After the price moves 20 pips in the intended direction, set the Stop Loss to breakeven.

What's on the Charts:

Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around these areas.

Red Lines: Channels or trend lines that indicate the current trend and the preferred trading direction.

MACD Indicator (14,22,3): Histogram and signal line�an auxiliary indicator that can also be used as a source of signals.

Major speeches and reports (always found in the news calendar) can significantly impact currency pair movements. Therefore, it's advised to trade cautiously or exit the market during their release to avoid sharp price reversals against prior movements.

Beginners trading on the forex market should remember that not every trade will be profitable. A clear strategy and money management are the keys to success in long-term trading.