Analysis of Trades and Trading Recommendations for the Euro

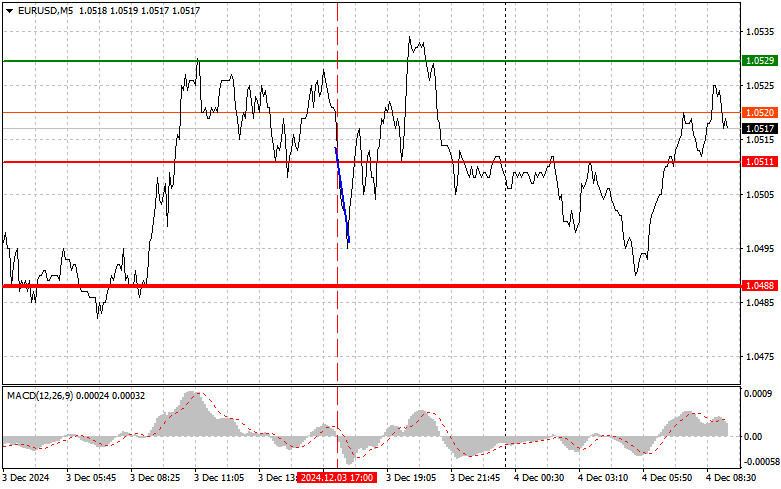

The test of the 1.0511 level coincided with the moment when the MACD indicator was beginning its downward movement from the zero mark, confirming a valid sell entry for the euro. As a result, the pair moved down approximately 17 pips, after which pressure on the euro subsided.

Today holds particular importance, and here's why. First of all, investors' attention will be focused on the data on the activity in the service sector of the Eurozone countries. The Services PMI, reflecting the state of the sector, is expected to come in at a weak level, likely pressuring the euro. The Composite PMI, combining manufacturing and services data, may disappoint traders. With low activity in the manufacturing sector, many economists anticipate a potential drop in the overall index, creating additional risks for the euro.

While the PPI continues to show moderate growth, it complicates the European Central Bank's decision-making process. Despite anticipated rate cuts, inflation volatility presents a paradox for monetary policy, which the market perceives as a potential obstacle to stabilization. The upcoming release of data risks putting significant pressure on the Euro, increasing uncertainty in the Eurozone's economic environment.

Given the unstable economic conditions in the eurozone, ECB President Christine Lagarde's remarks will be closely watched. Investors are eager to learn what strategy the ECB will adopt to address rising inflation risks and slowing economic growth. Should Lagarde advocate for more aggressive rate cuts, this could trigger a decline in the euro. Lower interest rates typically weaken the currency, potentially boosting exports. However, this approach raises concerns as the new U.S. President, Donald Trump, is expected to impose new protective tariffs on EU countries quickly.

Any negative data from the eurozone today could rapidly increase pressure on the euro. Regarding intraday strategy, priority will be given to implementing scenarios #1 and #2.

Buy Scenarios

Scenario #1:

Today, buying the euro is possible upon reaching the 1.0529 level (green line on the chart), targeting a rise to 1.0563. At 1.0563, I plan to exit the market and open sell positions, aiming for a 30-35 pip movement from the entry point. Expecting the euro to rise during the first half of the day is feasible only if strong data is released.

Important: Before buying, ensure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2:

I also plan to buy the euro today if the 1.0511 level is tested twice in succession while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. The expected targets are 1.0529 and 1.0563.

Sell Scenarios

Scenario #1:

I plan to sell the euro after reaching the 1.0511 level (red line on the chart). The target will be 1.0484, where I plan to exit the market and immediately open buy positions in the opposite direction, aiming for a 20-25 pip movement. Pressure on the pair could return anytime, but selling is preferable at higher levels.

Important: Before selling, ensure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2:

I also plan to sell the euro today if the 1.0529 level is tested twice in succession while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. The expected targets are 1.0511 and 1.0484.

What's on the Chart:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Notes for Beginner Forex Traders:

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.