The EUR/USD currency pair did not continue its sluggish downward movement from Wednesday and Thursday on Friday. As a result, we will have to wait once again for a correction. Let's briefly review the current technical situation regarding the European currency.

On both the weekly and monthly timeframes, we clearly have downward trends. The daily timeframe also shows a downward trend, but it is accompanied by a strong upward correction. This upward movement would not have occurred without the influence of Donald Trump's policies. However, the sharp decline of the US dollar has not managed to disrupt its overall upward trends across all higher timeframes. If the pair resumes its decline from current levels, all trends will remain in place, and the euro will likely head toward price parity or even lower.

Currently, the most significant news affecting the market is centered around Donald Trump. Decisions made by the Fed and the ECB in the near future seem less impactful, and the broader macroeconomic environment appears to be of little concern. It's clear that if the US anticipates difficult economic times, those challenges have not yet begun. Meanwhile, the EU economy has been stagnant for the past two and a half years. If the euro is rising, does this imply that the market expects a breakthrough in its economy? But what basis is there for such a breakthrough when Trump's tariffs are likely to slow it down even further? Already, German central bank head Nagel is warning that a recession could ensue if Trump imposes import duties on the European Union.

Thus, both the American and European economies appear on track to slow down. However, the American economy will shrink from a GDP growth of 2-3% per quarter, while the European economy will decline from a meager growth of 0.1-0.2% per quarter. Which economy is more likely to enter a recession?

The same logic applies to the monetary policies of the ECB and the Fed. The ECB is already cutting rates at every meeting and may be compelled to lower them below 2%, which is considered the unofficial "neutral mark." In the first quarter of 2025, we are increasingly hearing that the ECB could have to cut rates much further than previously anticipated. Under certain circumstances, the Fed may also decide to cut rates more than expected with Trump in office.

However, when we look at the current rates set by both the Fed and ECB, and the planned cuts, it suggests that while the situation in America may not be perfect, it is still likely to be better than in the EU. This understanding sheds light on why traders are fleeing from the dollar and why investors are pulling out of American stocks. We would also consider leaving, as Trump is increasingly viewed as a "time bomb." Nevertheless, the dollar is not as weak as it may seem, and the American economy is not facing serious problems—at least not yet.

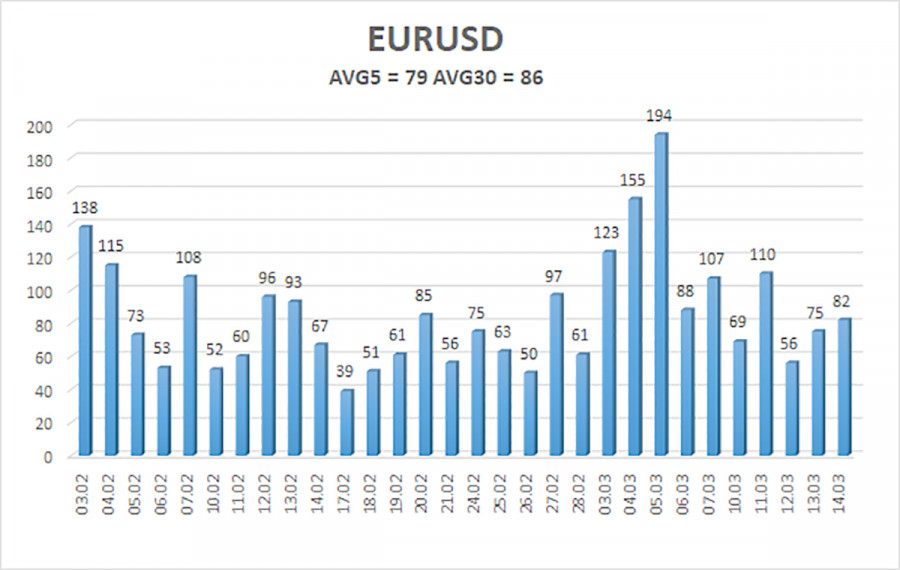

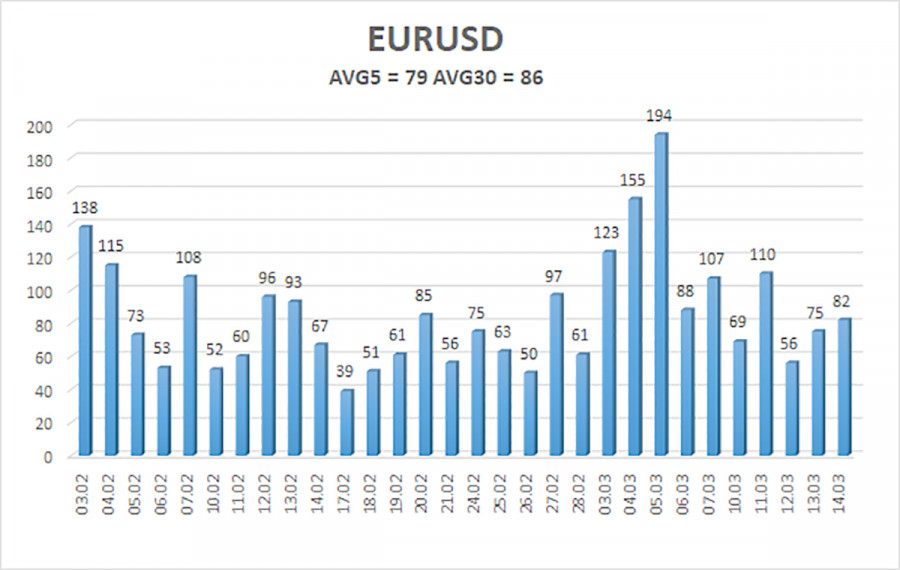

The average volatility of the EUR/USD currency pair over the last five trading days, as of March 17, is 79 pips and is considered "moderate." We expect the pair to move between the levels of 1.0800 and 1.0958 on Monday. The long-term regression channel has turned upward, but the global downtrend remains intact, as seen on higher time frames. The CCI indicator dipped into oversold territory, signaling another wave of upward correction, which now barely looks like a correction at all...

Nearest Support Levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest Resistance Levels:

R1 - 1.0986

Trading Recommendations:

The EUR/USD pair has exited the sideways channel and continues to show overall growth. In recent months, we have consistently stated that we expect the euro to decline in the medium term, and currently, nothing has changed in that regard. The dollar does not have any significant factors supporting a medium-term decline, aside from Donald Trump's influence. Short positions are still more attractive, with targets set at 1.0315 and 1.0254. However, it is quite challenging to predict when the current growth will come to an end. If you trade based purely on technical analysis, long positions can be considered as long as the price remains above the moving average, with targets at 1.0958 and 1.0986.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.