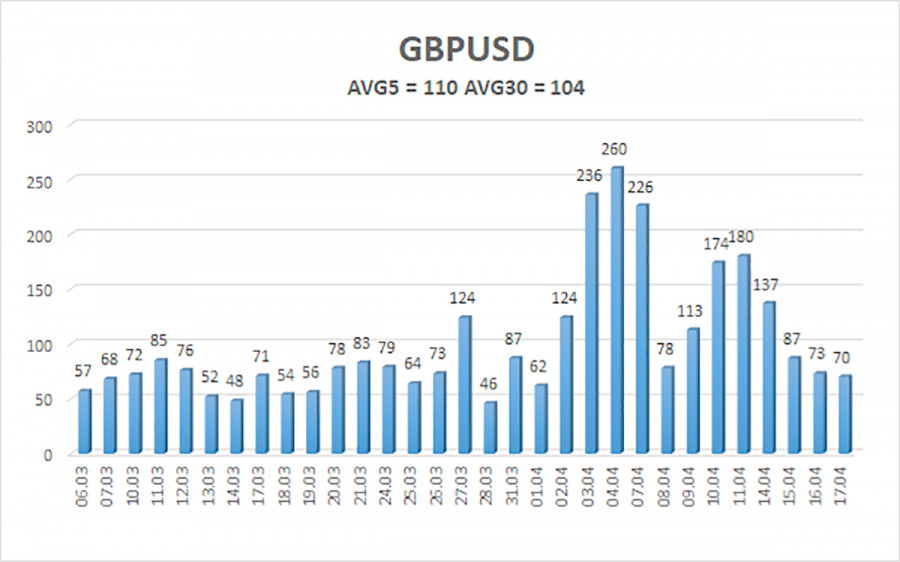

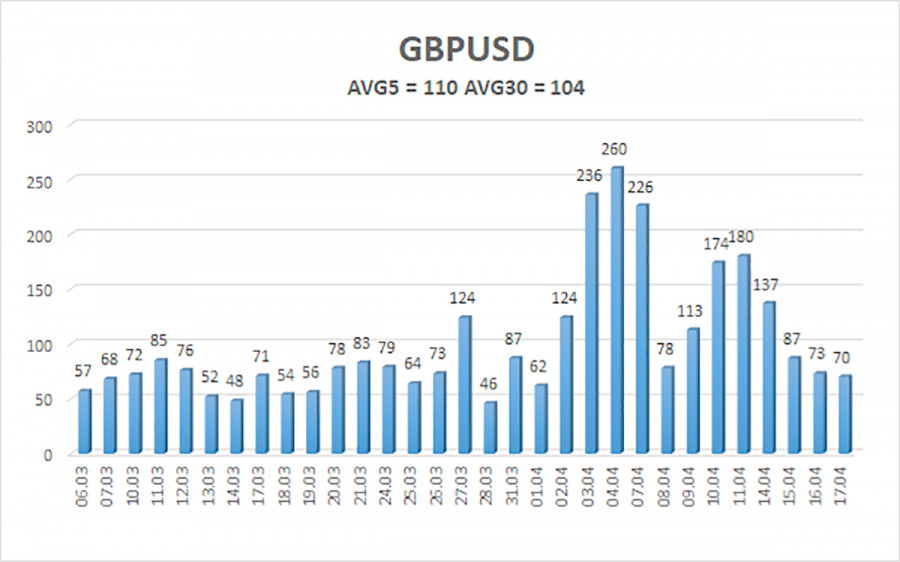

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction." The chart below clearly shows how rapidly volatility is decreasing, yet the market is in no hurry to close longs or open shorts. There are still no grounds for opening short positions, as the market continues to respond only to the trade war initiated by the U.S. against the rest of the world. All other macroeconomic and fundamental factors are currently irrelevant.

On Wednesday evening, Federal Reserve Chair Jerome Powell delivered a speech. From the start, we had no expectations of any new information from the head of the Fed. In early April, Powell clearly outlined not only his stance but also that of the entire Federal Open Market Committee. The consequences of the trade war are unpredictable and cannot be assessed at this stage, especially since Trump has not yet completed the implementation of tariffs and negotiations are still ongoing with several countries. Simply put, the time to "count the chickens" will come "in autumn"—once the final tariffs are in place and their first effects emerge.

Thus, the Fed's position remains unchanged: decisions will be based on macroeconomic data reviewed at each meeting. Of course, Powell reiterated that the U.S. economy will likely slow while inflation and unemployment will probably rise. But any economist or analyst could say that right now—you don't need to be the head of the U.S. central bank to draw such conclusions.

The U.S. dollar remains under heavy market pressure. Once again, we note a pattern: when no new tariffs are announced, the dollar stops falling. However, it still can't show any growth. This reinforces the point that the market is focused solely on the trade war factor. Since Powell did not announce anything new, the market practically ignored his speech.

The outlook for the Fed's key interest rate varies widely among opinions. Some experts believe the Fed will be forced to save the economy, which is "sinking" due to Trump's actions, and will cut rates even in the face of rising inflation. Occasionally, there are reports that inflation remains the Fed's top priority and that rates might be raised to fight it—even if that further damages the economy. We don't want to speculate. It's important to remember that central banks' monetary policy has no real influence on market sentiment. The dollar continues to plunge even though the Fed hasn't lowered rates since last year—and judging by official statements, it doesn't intend to do so in the near future. Meanwhile, the Bank of England may cut its rate as soon as the next meeting, given that UK inflation slowed significantly in March and the economy continues to struggle.

The average volatility of GBP/USD over the last five trading days is 110 pips, which is considered "average" for the pair. Therefore, on Friday, April 18, we expect movement within a range bounded by 1.3153 and 1.3373. The long-term regression channel is pointing upward, though a downward trend remains on the daily time frame. The CCI indicator recently entered the overbought zone, suggesting a pullback, which has already been concluded.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair continues its confident upward movement. We still believe that the entire upward move is a correction on the daily time frame, which has already taken on a somewhat irrational nature. However, if you trade using pure technicals or "the Trump factor," long positions remain relevant with targets at 1.3369 and 1.3428 since the price is above the moving average. Sell orders remain attractive, with targets at 1.2207 and 1.2146, but now, the market isn't even considering buying the U.S. dollar while Donald Trump continues to trigger new sell-offs of the American currency.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.