Analysis of Trades and Tips for Trading the British Pound

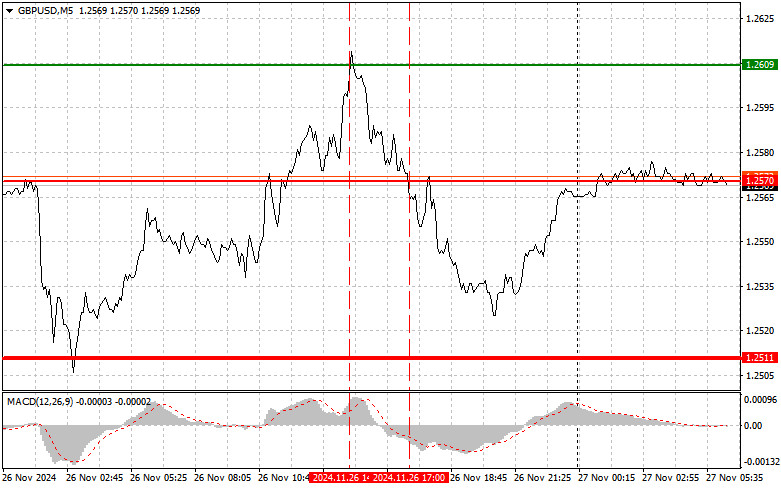

The test of the 1.2609 level occurred when the MACD indicator had already moved significantly upward from the zero mark, limiting the pair's upward potential. For this reason, I did not buy the pound. During the middle of the US session, the 1.2570 level was tested, but it too coincided with the MACD indicator being significantly below the zero mark, so I also refrained from selling the pound.

Data on US consumer confidence reflects growing optimism among Americans about the economy, which, in turn, boosts demand for the dollar. Figures consistent with analysts' expectations underscore economic stability and support improved forecasts for consumer spending. Amid stable inflation and ongoing Federal Reserve policy adjustments, such optimism has strengthened the US dollar. As a result, the British pound came under pressure in the second half of the day.

Given the uncertainty in the UK economy and domestic political challenges, traders sought safer assets, further pressuring the pound. Investors also became more cautious about the pound due to increasing expectations of US trade tariffs on the UK, which, as announced by Donald Trump yesterday, are as certain as those imposed on Mexico, Canada, and China.

Today, there is no economic data from the UK, providing the pound with a chance for a limited correction. Regarding intraday strategy, I will focus on implementing Scenarios #1 and #2.

Scenarios for Buying

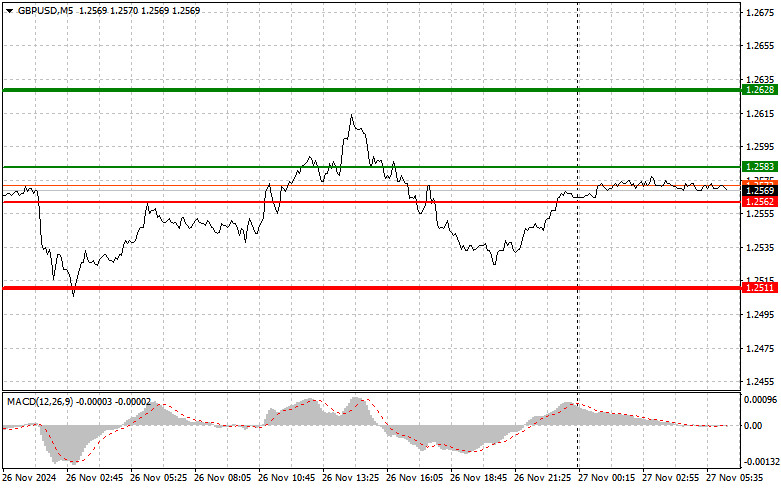

Scenario #1: Today, I plan to buy the pound at the 1.2583 level (green line on the chart), targeting a rise to the 1.2628 level (thicker green line on the chart). At 1.2628, I will exit my buy trades and open sell trades in the opposite direction, expecting a movement of 30-35 points downward from that level. Any rise in the pound today is likely to occur only as part of a correction.Important: Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.2562 level when the MACD indicator is in the oversold zone. This setup should limit the pair's downward movement and trigger a reversal upward. Growth toward the levels of 1.2583 and 1.2628 can be expected.

Scenarios for Selling

Scenario #1: I plan to sell the pound after it breaks below the 1.2562 level (red line on the chart), which is likely to lead to a rapid decline in the pair. The key target for sellers will be the 1.2511 level, where I plan to exit my sell trades and immediately open buy trades in the opposite direction, targeting a movement of 20-25 points upward from that level. Selling the pound is possible, but it's preferable to do so at higher levels.Important: Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the pound in the event of two consecutive tests of the 1.2583 level when the MACD indicator is in the overbought zone. This setup will likely limit the pair's upward potential and result in a reversal downward. A decline toward the levels of 1.2562 and 1.2511 can be expected.

Chart Notes

- Thin green line: Entry price for buying the pound.

- Thick green line: Projected price for setting Take Profit or manually securing profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the pound.

- Thick red line: Projected price for setting Take Profit or manually securing profits, as further declines below this level are unlikely.

- MACD Indicator: It is important to consider overbought and oversold zones when entering the market.

Important Note for Beginner Traders

Beginner forex traders must exercise extreme caution when making market entry decisions. It is best to stay out of the market before the release of significant fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you could quickly lose your entire deposit, especially if you trade large volumes without proper money management.

Successful trading requires a clear plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is generally ineffective for intraday traders.