U.S. Indexes Close Lower: 'Chip' Fever and Earnings Expectations

The American stock market ended Wednesday with a decline, as chipmakers slipped and investors paused, awaiting corporate earnings.

Microsoft: Beating the Estimates

After the market closed, Microsoft and Meta Platforms (banned in Russia) reported earnings that exceeded revenue forecasts. These positive results drew attention to upcoming reports from other tech giants, reinforcing confidence in the "heavyweights" of the tech market.

Alphabet: 'Magnificent Seven' Reports Offer a Bright Spot

Among the largest players in the top "Magnificent Seven," Alphabet also showed impressive results. Its 2.8% growth on Tuesday after beating third-quarter revenue and earnings expectations gave the market a small boost, helping to offset the negative impact from the decline in chipmaker stocks.

Chipmakers Under Pressure: AMD and Qorvo Slump

Shares of Advanced Micro Devices (AMD) and Qorvo faced significant pressure. Grim forecasts triggered drops of 10.6% and 27.3% in their stock prices, respectively.

Heavy Losses for Super Micro and Nvidia

Super Micro Computer dropped 32.6% after Ernst & Young stepped down as the company's auditor. Nvidia also ended in the red, with a 1.4% drop.

Tech Sector Hit Hard

The information technology sector saw the biggest drop among S&P 500 sectors, down 1.34%, while the communication services sector showed slight growth due to Alphabet's success.

Market Optimism Fades

According to Michael James, managing director of equity trading at Wedbush Securities, the volatility in Qorvo, Advanced Micro, and Super Micro stocks is raising questions and "dulling the rosy picture" set by Alphabet's impressive report.

Focus Turns to Earnings and Forecasts

"There will be a laser focus on earnings and company guidance reports," added James, highlighting the intense anticipation among investors.

Small Losses but Significant Expectations

Wednesday ended with small declines across major indexes. The Dow Jones Industrial Average fell by 91.51 points (0.22%) to settle at 42,141.54. The S&P 500 also slipped, down by 19.25 points (0.33%) to 5,813.67, while the Nasdaq Composite recorded the largest drop, losing 104.82 points (0.56%) to close at 18,607.93.

U.S. Economy Grows but Below Expectations

According to preliminary data from the U.S. Department of Commerce, GDP grew by 2.8% annually in the third quarter, slightly below the forecasted 3.0% growth rate. This minor gap between actual and expected results raised some concerns in the market, although the overall growth trend remains positive.

Private Sector Exceeds Job Growth Expectations

In other positive news, the private sector saw stronger-than-expected job growth. October added 233,000 new jobs, above forecasts, signaling steady recovery in the labor market and giving investors a reason for optimism, reinforcing expectations of consumer activity and economic strength.

Political Tensions: Harris and Trump Run Neck-and-Neck

With the upcoming presidential election on November 5, the race between Kamala Harris and Donald Trump is a hot topic among market participants. According to the latest polls, the candidates are running neck and neck. Investors are keeping a close eye on the election's potential impact on economic policy and the market.

Disappointing Corporate Reports: Eli Lilly and Starbucks

Eli Lilly disappointed investors, dropping 6.2% after falling short of sales forecasts for its popular weight loss and diabetes medications. Analysts expected better results, leading to a decline in the pharma giant's stock.

Starbucks reported a decline in quarterly sales, with a decrease in global demand impacting the company's profits. Investors closely monitoring the cafe chain received confirmation that global economic challenges have affected even the largest brands.

NYSE Remains Positive Despite Declines

Despite the overall market downturn, the New York Stock Exchange showed a positive balance: for each stock that declined, another rose. A total of 210 new highs and 52 new lows were recorded, indicating a mixed sentiment, with many investors remaining optimistic.

New Highs and Lows: S&P 500 and Nasdaq Show Divergent Movement

The S&P 500 recorded 24 new 52-week highs and five new lows, while the Nasdaq Composite saw 126 new highs and 98 new lows. This divergence in performance illustrates mixed investor sentiment, with investors balancing between growth expectations and concerns for the tech sector.

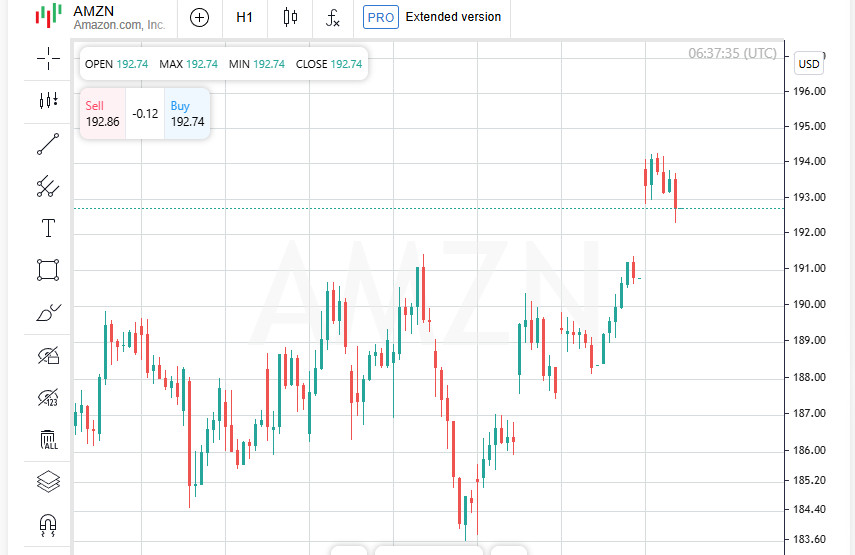

Amazon Up Next: Markets Brace for Earnings Report

Amazon is expected to release its financial results on Thursday, and the forecasts suggest trends similar to recent reports from other tech giants. Investors worry that aggressive investments in AI and infrastructure could impact the company's high margins, potentially reducing interest in its stock.

Tech Sector Under Pressure: AI Comes at a High Cost

Shares of major tech giants continued to decline in aftermarket trading on Wednesday. A key challenge these companies face is balancing ambitious AI initiatives with the need to demonstrate short-term returns. "Investing in AI is costly. Building capacity is expensive," commented GlobalData analyst Beatriz Valle.

Capacity Competition: Capital Expenditures on the Rise

Tech corporations are in a race to build AI infrastructure, but widespread adoption of the technology will take time. According to Visible Alpha, Microsoft's quarterly capital expenditures now exceed its annual spending level before 2020. Meta has also significantly increased its spending, with quarterly investments now comparable to its annual costs before 2017.

Microsoft: AI Spending Increases and Potential Azure Slowdown

Microsoft reported a 5.3% increase in capital spending to $20 billion in the first fiscal quarter and confirmed further increases in AI investment in the coming quarter. However, the company warned that growth in its Azure cloud business may slow due to limited data center capacity. This statement added to investors' concerns.

These investments will undoubtedly help tech giants strengthen their positions in the AI market in the long term, but for now, the question of profitability and margin growth remains open.

Investments and Their Impact: Microsoft Slows Margins for Future Gains

Head of technology research at D.A. Davidson, Gil Luria, points out, "Investors sometimes overlook that each time Microsoft makes major investments, it dampens the company's margin by a full percentage point, which can drag on for the next six years." According to Luria, the current capital expenditures could slow Microsoft's margin metrics, creating a temporary barrier to profitability.

Chipmakers Struggling to Meet Demand: AI Growth Drives Shortages

Chip manufacturers like Nvidia face challenges in meeting the growing demand for AI components. Advanced Micro Devices, which reported earnings earlier this week, emphasized that AI chip demand is surging faster than production capacity. The company warned that AI chip supply will likely remain limited into next year, leaving some orders unfulfilled.

AI Investments Echo the Early Days of Cloud Technology

These substantial investments by tech giants hark back to the times when companies actively invested in cloud technology, waiting for customers to adopt and adapt to the new technology.

High-Stakes Bet on AI Infrastructure

"We're on the verge of significant opportunities, even if building infrastructure may raise questions for investors in the short term," said Meta (banned in Russia) CEO Mark Zuckerberg, commenting on the company's current spending. He stressed that the company plans to continue making substantial investments in AI infrastructure, preparing for future demand and long-term results.