EUR/USD

Analysis:The bearish wave that began in August continues to develop. The bullish wave forming since late November remains corrective, with its level not exceeding the retracement of the prior trend segment. Last week, the price reached the calculated resistance zone.

Forecast:This week, the euro is expected to exhibit sideways movement. A retest of the calculated resistance zone is anticipated in the early days, with increased volatility and a return to bearish momentum expected by the end of the week.

Potential Reversal Zones:

- Resistance: 1.0600/1.0650

- Support: 1.0380/1.0330

Recommendations:

- Selling: No trading conditions until reversal signals emerge near resistance.

- Buying: Limited potential purchases may result in losses.

USD/JPY

Analysis:The short-term trend is guided by an ongoing upward extended flat wave. The downward movement since early October is a correction of the previous upward trend and is nearing completion.

Forecast:The current decline is expected to conclude this week, with a reversal forming in the calculated support zone and a subsequent upward price movement. Calculated zones provide a potential weekly range for the pair's movement.

Potential Reversal Zones:

- Resistance: 153.70/154.20

- Support: 149.50/149.00

Recommendations:

- Buying: Can be entered fractionally after reversal signals appear.

- Selling: Possible intraday with reduced volume sizes, considering the limited downward potential.

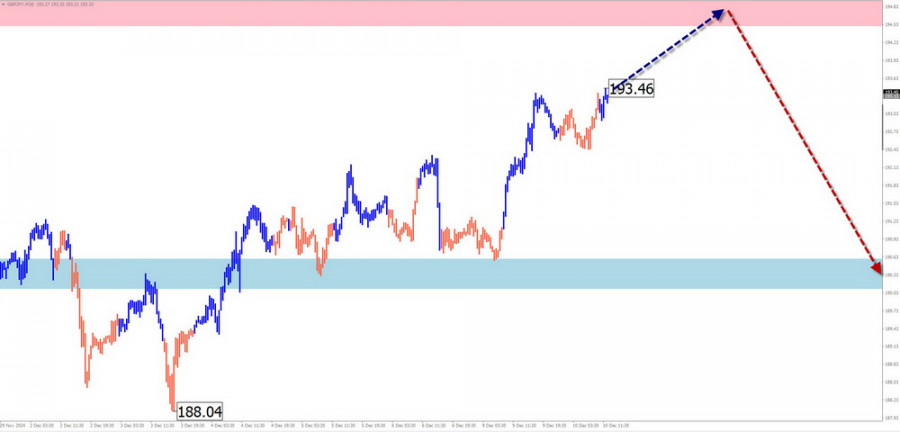

GBP/JPY

Analysis:The ongoing upward trend in the pound-yen cross began in August. Over the past two months, the pair has mostly moved sideways, forming a corrective extended flat wave (B), now nearing completion.

Forecast:The cross is expected to move upwards in the coming days, potentially reaching the calculated resistance zone. A subsequent decline may follow, limited to the support zone boundaries.

Potential Reversal Zones:

- Resistance: 194.50/195.00

- Support: 190.60/190.10

Recommendations:

- Selling: Premature before the current wave completes and may result in losses.

- Buying: Acceptable during individual trading sessions with fractional volume sizes.

USD/CAD

Analysis:The short-term bullish wave since September 25 continues to guide the pair. The price has reached the lower boundary of a strong reversal zone. The wave structure appears complete, but no imminent reversal signals are visible on the chart.

Forecast:After potential pressure on the resistance zone early in the week, a reversal and the start of a downward trend are expected. A brief breach of the reversal zone's upper boundary is possible before the direction changes.

Potential Reversal Zones:

- Resistance: 1.4260/1.4310

- Support: 1.4090/1.4040

Recommendations:

- Buying: Possible with reduced volume sizes during individual trading sessions.

- Selling: Consider fractionally after confirmed reversal signals in the resistance zone.

NZD/USD

Analysis:The short-term trend for the New Zealand dollar has been guided by a bearish wave since September. By late November, prices reached a strong reversal zone. While the wave structure appears complete, no definitive reversal signals are present on the chart.

Weekly Forecast:The pair is expected to move within a channel defined by the nearest reversal zones. Initial pressure on the support zone may occur, with a directional shift and retracement toward resistance likely by the end of the week or early next week.

Potential Reversal Zones:

- Resistance: 0.5980/0.6030

- Support: 0.5800/0.5750

Recommendations:

- Buying: Possible intraday with fractional volume sizes but limited potential.

- Selling: Not advisable until confirmed reversal signals appear near resistance.

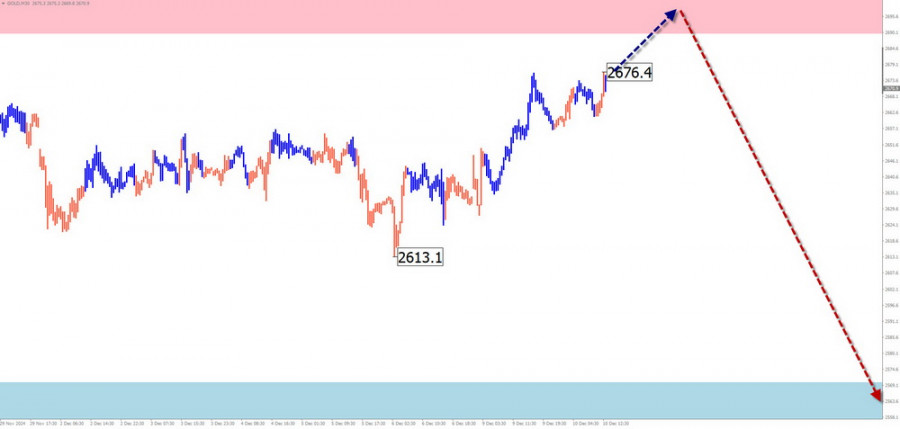

Gold

Analysis:After peaking in late October, gold prices have been correcting downward. The analysis of the corrective wave indicates the absence of a concluding (C) segment. The lower boundary of a strong reversal zone coincides with the calculated resistance area.

Forecast:In the next couple of days, a retest of the resistance zone is likely. Subsequently, a directional shift toward the calculated support zone is expected, with the highest volatility anticipated later in the week.

Potential Reversal Zones:

- Resistance: 2690.0/2710.0

- Support: 2570.0/2550.0

Recommendations:

- Buying: Limited potential and high risk.

- Selling: Suitable for short-term trading during individual sessions, contingent on reversal signals near resistance.

Explanation of Simplified Wave Analysis (SWA):

- All waves consist of three parts (A-B-C).

- Only the latest, incomplete wave is analyzed for each timeframe.

- Dotted lines indicate expected movements.

Attention: The wave algorithm does not account for the duration of price movements over time.