The GBP/USD currency pair traded very calmly on Thursday, as on Wednesday evening. As the chart below clearly shows, volatility has recently dropped to noticeably low levels. What is 60 pips per day for the British pound? Essentially, it's price stagnation. On Wednesday evening, the Federal Reserve had a chance to stir up the market and support the dollar. And the Fed did everything it could to spark dollar strength, even though that wasn't its direct intention. Powell's rhetoric and the Fed's decisions were hawkish, as they have been in all recent meetings. True, they weren't "ultra-hawkish," but at this point, the market ignores everything except Donald Trump's tariffs, which it sees as the proverbial red flag. Everything else fades into the background. Given this context, the Bank of England never had much chance to influence market sentiment significantly.

Sure, the dollar could have strengthened, and the pound could have declined — because this is the currency market, where anything is possible. But the key point isn't even the one-sided movement we've seen in recent weeks. What matters is that the market is ignoring almost every factor that could support the dollar. The Fed meeting was just the "cherry on top." As a result, the British pound dipped slightly, but it wasn't even a correction — not even a pullback. It was merely noise.

The Bank of England left the key interest rate unchanged, exactly as expected. Only one MPC member voted for a rate cut, while analysts had expected two. Therefore, the outcome can technically be called "moderately hawkish."." Since the tone was hawkish, the market immediately rushed to buy the pound and sell the dollar.

In short, the two most important events of the week had virtually no impact on the market's overall direction. Also, weak macroeconomic data from the UK has also failed to pressure the British currency. While the unemployment rate remained unchanged, the number of unemployed increased by 44,000 in February, far above forecasts. The unemployment report covered January, so we expect a rise in the headline rate next month.

As ironic as it may sound, the current rally in the pound is still a correction on the daily timeframe. The pound has gained 900 pips in two months, but it's still corrective, as the preceding drop was even more significant. Over the long term, the pound continues to follow a 16-year-old downtrend. For a trend of that scale, a 900-pip rally means nothing. Over the past 16 years, the British pound has depreciated from $2.12 to $1.04. We still see no fundamental basis for a sustained long-term uptrend in the pound — except for Trump.

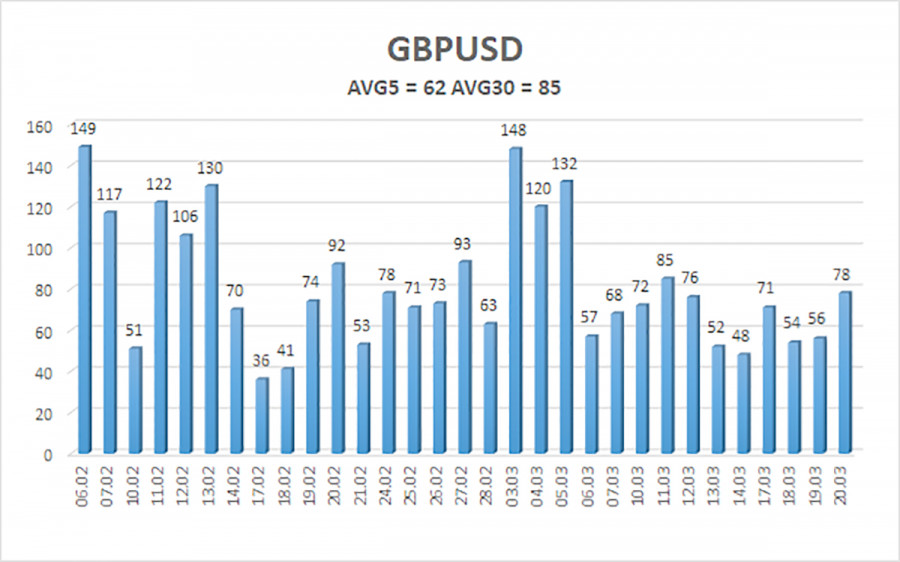

The average volatility of the GBP/USD pair over the last five trading days is 62 pips, which is considered "moderate-low" for this currency pair. On Friday, March 21, we expect the pair to trade within a range of 1.2899 to 1.3023. The long-term regression channel has turned upward, but the downtrend remains intact on the daily timeframe. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Nearest Resistance Levels:

R1 – 1.3062

R2 – 1.3184

R3 – 1.3306

Trading Recommendations:

The GBP/USD pair maintains a medium-term downtrend, though on the 4-hour timeframe, it continues to show confident short-term gains. We do not recommend long positions, as we believe the current upward move is just a correction, which has now turned into an illogical, panic-driven rally. However, if you're trading based on pure technical analysis, long positions remain valid above the moving average, with targets at 1.3023 and 1.3062. Short positions are still the more attractive option, with medium-term targets at 1.2207 and 1.2146, because this correction will eventually end. The British pound looks extremely overbought and unjustifiably expensive, and Donald Trump won't be able to devalue the dollar forever. It's uncertain how long the dollar sell-off triggered by Trump will continue.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.