The GBP/USD currency pair traded very calmly on Wednesday, considering the evening movements. As a reminder, we are not analyzing the results of the Federal Reserve meeting yet, as too little time has passed. The market has not yet settled or fully digested the information—it needs time. Considering price movements before the announcement and Powell's speech, they were not much different from previous days. Volatility remained low, and the British pound maintained its upward momentum despite having no fundamental support other than Donald Trump's protectionist policies.

Even if the dollar shows significant growth today, will it change anything fundamentally? Will the market suddenly stop reacting to U.S. tariffs, leading America toward recession?

The market ignores the relatively strong U.S. economy, positive macroeconomic data, and Federal Reserve policy. In 2025, the Fed is much more hawkish than the market expected at the end of 2024, but this has had no impact in recent weeks and months. The market is protesting against Donald Trump's policies, and as a result, despite two long-term bullish trends for the dollar, the greenback continues to struggle.

Following the Fed, the Bank of England will hold its meeting today. The key interest rate will likely remain unchanged, but the most crucial factor will be how many of the nine Monetary Policy Committee members vote for a rate cut. Experts predict that two members will vote in favor of a rate cut, but if the number is three or more, this could halt the pound's relentless rally—though not necessarily ending it.

As mentioned, the Fed's monetary policy currently means little to the market, and the Bank of England's policy matters even less. The British economy is already on the verge of recession, even without potential U.S. tariffs. Even if those tariffs are avoided, the BoE's priority remains controlling inflation, which has been rising significantly. Thus, while the ECB is cutting rates to stimulate the economy, the BoE is cutting rates very slowly to fight inflation. This indirectly supports the British pound, which continues to rally aggressively.

The market now has sufficient information regarding the impact of Donald Trump's tariffs to make informed trading decisions. Consequently, regardless of the outcomes of the Fed and BoE meetings, the dollar may experience some growth. However, any significant changes will only occur when market participants stop relying solely on the "Trump factor." It is difficult to predict exactly when this will happen, but for the time being, the downward trend persists on the daily timeframe. Aside from the influence of Trump, there have been no substantial reasons for the pound sterling to strengthen.

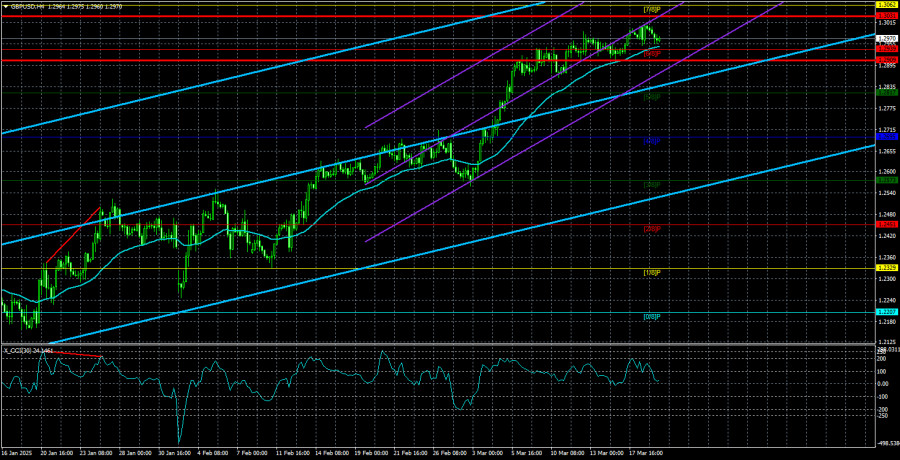

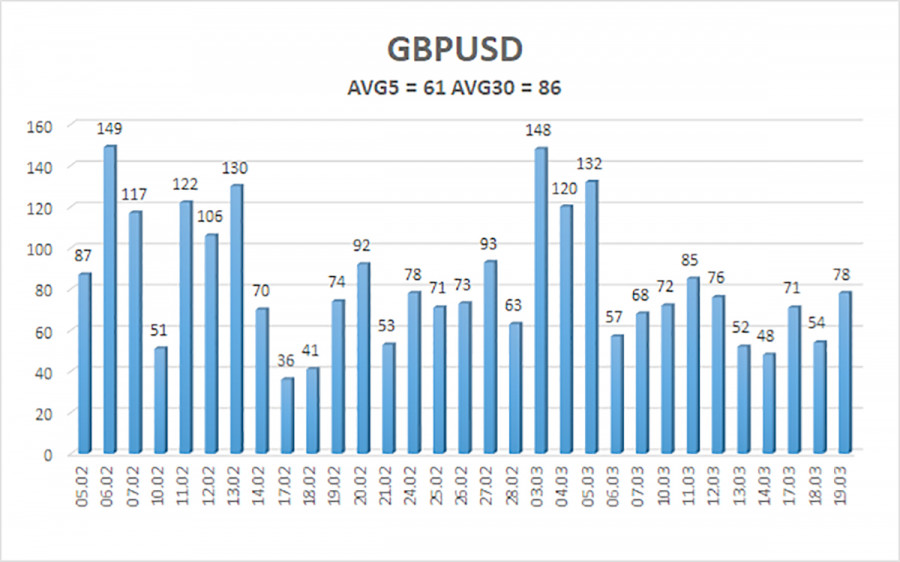

The average volatility of the GBP/USD pair over the last five trading days is 61 pips, which is considered "moderate-low" for this currency pair. On Thursday, March 20, we expect the pair to trade within a range of 1.2909 – 1.3031. The long-term regression channel has turned upward, but the downtrend remains intact on the daily timeframe. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Nearest Resistance Levels:

R1 – 1.3062

R2 – 1.3184

R3 – 1.3306

Trading Recommendations:

The GBP/USD pair remains in a medium-term downtrend, but a strong rally continues in the 4-hour timeframe. We still do not consider long positions. We view the current upward movement as a correction that has now become an illogical, panic-driven rally. However, long positions above the moving average are valid for traders who rely on pure technical analysis, with targets at 1.3031 and 1.3062. Short positions remain attractive, with targets at 1.2207 and 1.2146, because the daily timeframe's upward correction will end sooner or later. The British pound looks extremely overbought and unjustifiably expensive, but Donald Trump continues to push the dollar into the abyss. How long will the "Trump-driven dollar collapse" last? That remains very difficult to predict.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.